Powering Savings: Exploring Solar Panel Financing Options

Investing in solar panels is a substantial step towards sustainable and cost-effective energy solutions. However, the upfront costs can be a barrier for many homeowners. Fortunately, various solar panel financing options make this clean energy transition accessible, offering flexibility and affordability.

Government Incentives and Rebates: Reducing Upfront Costs

Governments around the world recognize the importance of promoting solar energy adoption and often provide incentives and rebates to mitigate upfront costs. These financial incentives can significantly offset the initial investment, making solar panels more financially feasible for homeowners. Researching and leveraging these government programs is a crucial first step in exploring solar panel financing.

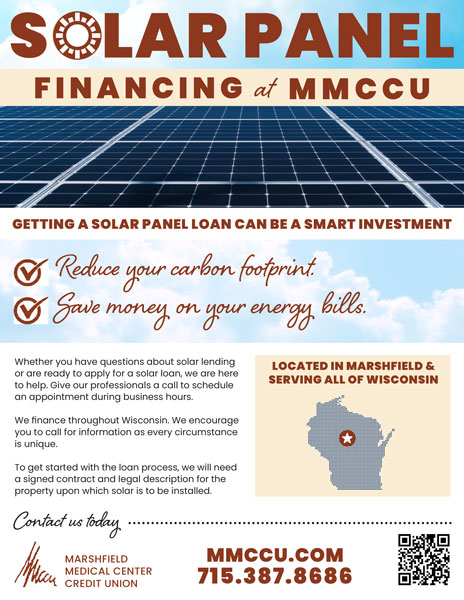

Explore Solar Panel Financing: Solar panel financing

Solar Loans: Affordable Payment Plans

Solar loans are a popular financing option, allowing homeowners to borrow money specifically for solar panel installation. These loans come with competitive interest rates and flexible repayment terms. Homeowners can choose from various loan options, including secured and unsecured loans, tailoring the financing to their financial situation. Solar loans provide an effective way to spread the cost of solar panel installation over time.

Solar Leases: Renting Solar Power

For those who may be hesitant about taking on a loan or unable to afford the upfront costs, solar leases offer an alternative. In a solar lease arrangement, homeowners essentially rent the solar panels and pay a fixed monthly fee for the energy they generate. While they don’t own the panels, they benefit from the clean energy produced without the burden of ownership and maintenance costs.

Power Purchase Agreements (PPAs): Buying Solar Energy

Power Purchase Agreements (PPAs) are another innovative approach to solar panel financing. In a PPA, homeowners agree to purchase the energy generated by the solar panels rather than owning the panels themselves. This arrangement is often facilitated by a third-party provider, and homeowners pay for the electricity produced at a predetermined rate. PPAs provide a way to access solar energy without the initial investment in equipment.

Home Equity Loans: Tapping into Home Value

Homeowners with substantial equity in their homes may consider using home equity loans to finance solar panel installation. These loans use the home as collateral, allowing for larger loan amounts and potentially lower interest rates. While it leverages the value of the home, it provides an avenue for homeowners to invest in a sustainable and energy-efficient future.

Community Solar Programs: Shared Solar Benefits

Community solar programs are gaining popularity as a collaborative approach to solar energy. In these programs, a community collectively invests in a solar system that is typically located off-site. Participants benefit from the energy generated, and the costs are distributed among the community. Community solar is an inclusive option for those who may not have suitable rooftops for solar installations.

Solar Financing Companies: Specialized Lenders

Many financial institutions and specialized solar financing companies offer tailored financing solutions for solar projects. These companies understand the unique aspects of solar panel financing and may provide attractive terms and rates. Exploring options from specialized lenders ensures that homeowners can access expertise in solar financing.

Tax Credits: Further Incentives for Savings

In addition to government incentives and rebates, tax credits provide further financial benefits for solar panel installations. Homeowners can receive a percentage of the installation costs as a credit against their income taxes. This reduces the overall tax burden, providing additional savings and making solar panel financing even more attractive.

In-House Financing from Solar Providers: Seamless Integration

Many solar installation companies offer in-house financing options, streamlining the process for homeowners. These financing packages may include low-interest loans or other favorable terms. Choosing in-house financing from reputable solar providers ensures a seamless integration of the financing process with the solar installation project.

Comparing Options: Making Informed Decisions

With a variety of solar panel financing options available, it’s crucial for homeowners to compare and evaluate each option carefully. Considerations should include interest rates, repayment terms, ownership structures, and potential savings over time. Making informed decisions about solar panel financing ensures that homeowners maximize the benefits of clean and sustainable energy.

Conclusion: Powering Homes and the Planet

Solar panel financing opens the door for homeowners to embrace renewable energy without a significant upfront financial burden. Whether through loans, leases, or community programs, there are diverse options to suit different financial situations. To explore solar panel financing and take the first step towards a sustainable energy future, visit Solar Panel Financing.